This is post is taken from the Frequently Asked Questions.

When you earn dollars or any other fiat currencies, you are exchanging your valuable time for a token that reflects the value of the work that you did. We exchange our contributions to society, our energy in an abstracted form, and earn money. This fixes the coincidence of wants because the earned tokens are valued by everyone in the society. The problem is that through no fault of your own, the time that you worked to earn that money is being slowly stolen from you. As the government prints more and more money, that money is valued less and less. The government is effectively stealing from our future. Even the “target” inflation of 2% means that if you kept your money under the bed, in 35-36 years it would be worth half of what it had been worth.

Imagine the scenario where someone works hard all their life and saves those dollars. Upon retirement he’ll try to redeem all that hard work that he thought was stored into those dollars. What he’ll realize is that he wasted half of his life working for nothing thanks to the government slowly robbing him through inflation.

Inflation is a relatively hidden tax in the more stable western countries due to its lower rate, but is all too common in the less developed countries of the world where inflation can run over 20-50% year so even more in situations of hyperinflation.

To top it off, when you spend your inflated money, the government expects you to pay taxes on all of it. Tax when you earn it and additional taxes on any profits from investing it, even if all you did was keep up with the effects of inflation.

Inflation would be less of an issue if wages kept up with inflation, but that is not the case. Really the only thing that has allowed the wealthiest in the country to not be effected by inflation as much is their ability to earn enough that they can afford to invest the rest in assets like real estate or stocks. Both of these have historically been decent places to park your money until you need it. They are considered more risky investments. We should not be forced to place our hard earned money into risky investments just to have the chance of beating inflation. Someone that works hard all their life and stores his hard work as cash shouldn’t be penalized. This is one of the main reasons for the wealth inequality gap: the fact that the more wealthy are able to take the risk of holding everything but cash. The wealth gap is not because the rich are not taxed enough; it is a socialist attitude in my opinion that they are not paying their fair share.

As they say, bitcoin fixes this. By saving in bitcoin rather than cash, you are choosing to save in a system that is not inflationary. A system that has a fixed supply that a government cannot choose to create more of on a whim. A system that rewards you just by holding onto it.

Bitcoin is a reminder that a currency can exist without inflation. Without the government slowly stealing from us.

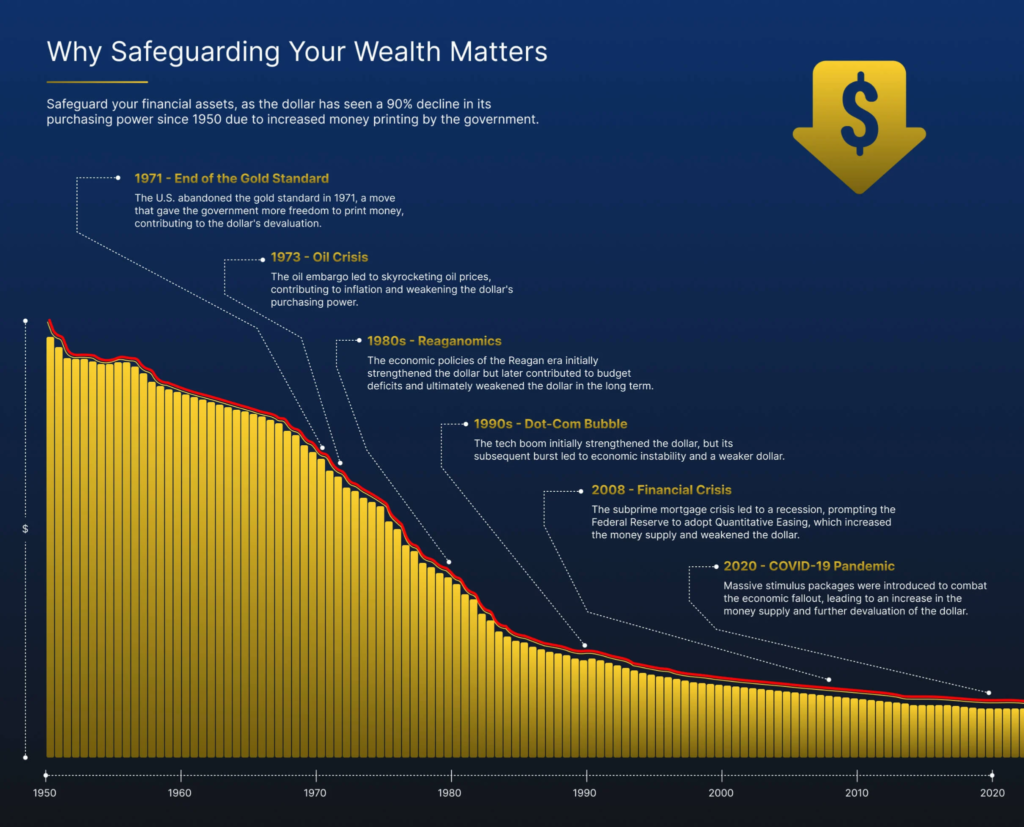

Bitcoin is an alternative to the dollar. The one thing that ties most investments together is that they are denominated in dollars, which has continuously lost value overtime. The chart below (from this site) shows that today’s dollars are worth 90% less than what they were worth in 1950. You work and are paid in dollars. You exchange your time on this earth for money that you then hope to be able to exchange for other people’s work at a future date.

Stocks and real estate will not go away, but their current purpose as a way to make sure you don’t lose value due to inflation will diminish as bitcoin continues to become more valuable. Future investments will have to be made on the basis of if you are willing to part with your bitcoin for that investment.

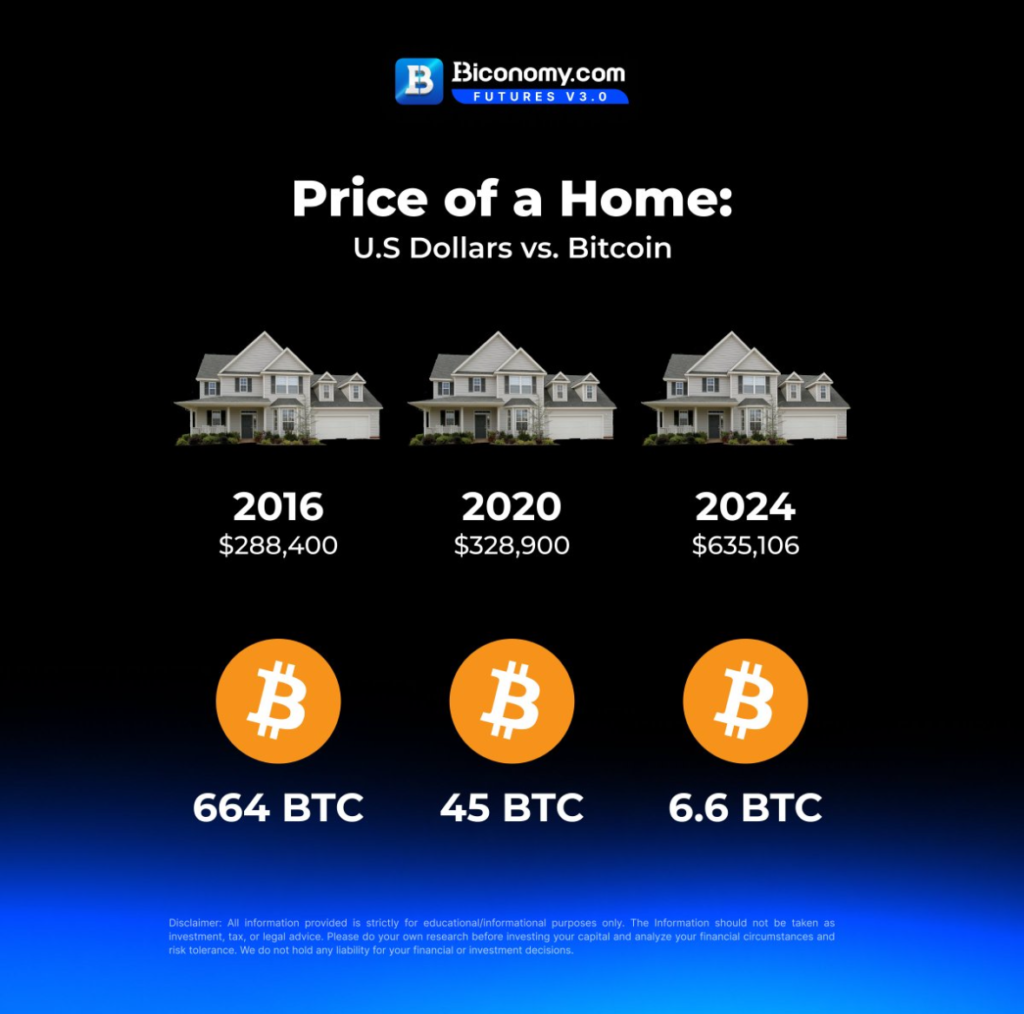

In the current system, real estate has gone from being a consumable good that people buy to live in and raise a family to a store of value. Very wealthy families and corporations are buying up real estate since, until bitcoin, there were only equities and real estate as a better alternative to put your money to store its value. (Gold could be considered a store of value too but historically has underperformed the stock market). As more and more real estate gets bought up by the wealthy, this means that the middle class can hardly afford to buy a house any longer as house prices get inflated higher and higher. Even children of wealthy families (unless getting support by the parents) are no longer able to afford a home independently until later in life than their parents or grandparents.

The average home price in 1950 was $7,354, which should equate to $93,602 in today’s dollars. However, that’s not the case today. The average home price is around $420,000. Has income increased that much to make up for the difference? The average family income in 1950 was $3,300. The average salary in US is around $64,000. If you factor in inflation, a $3,300 income in 1950 would equate to $43,200, so incomes have actually increased faster than inflation.

In 1950 the average home was 2.2x the average salary. Today the average home is 6.6x. What else is inflated? Are younger people’s 401k’s buying into a stock market that is similarly inflated for the same reason? With fiat money, we don’t actually know the true value of things any more. These are some of the issues, in my opinion, that bitcoin frees you from.

A transition to bitcoin will encourage businesses to produce higher quality products. We are currently living in the fiat mindset that we must constantly consume goods and services. Why hold onto our money for the future when it will just be worth less. We might as well spend it now because then we’d at least have something tangible. In a bitcoin world, businesses would compete on quality because they’d be fighting over where we’d spend our valuable bitcoin.

To continue on the theme of bitcoin being energy money, let’s consider pricing bitcoin in terms of barrels of oil.

At the end of August 2024, 1 BTC gets you 785 barrels of oil ($81/barrel). This is up from 309 barrels of oil a year ago, an increase in purchasing power of your bitcoin in terms of oil of 154%. The S&P 500 index moved from 4433 to 5613 over that same year period, an increase of 26.6%. In terms of oil, the S&P can buy you 31.2% more oil now than a year ago.

Leave a Reply