What is Bitcoin?

Bitcoin is a peer-to-peer form of digital money. Attempts at creating digital money have been made in the past, but Bitcoin is the first that has succeeded.

To understand Bitcoin, you need to understand money.

What is money?

Early people bartered. Say you grow apples and your neighbor is a fisherman. You exchange a certain number of apples for his fish. However, what if you only have apples and your shoemaker only wants fish at the moment? You’d have to first exchange the number of apples with your neighbor in order to get enough fish to trade with the shoemaker. What if the neighbor with the fish doesn’t want to trade or doesn’t have enough fish? There is a coincidence of wants. Wikipedia describes a coincidence of wants as an “economic phenomenon where two parties each hold an item that the other wants, so they exchange these items directly.”

Barter does work even to this day but is very inefficient when it comes to larger economies.

Larger economies require a money that does not otherwise have any other utility besides being valued as money. Money used at scale should not be able to be consumed or otherwise used for anything other than its ability to coordinate trading of goods or services.

Basically, money needs to be a good store of value.

Taken from the excellent article by Vijay Boyapati called The Bullish Case for Bitcoin, an ideal store of value should be:

- Durable: must not be perishable or easily destroyed. Food, therefore, is not a good store of value because it spoils.

- Portable: must be easy to transport and store against loss or theft. Apples are fairly easy to transport in small amounts but if you are purchasing a larger item, the amount needed would be unmanageable.

- Fungible: one item of the good should be interchangeable with another. There should be no difference in quality between any of the items.

- Verifiable: the good must be easy to identify as authentic.

- Divisible: the good must be easy to subdivide.

- Scarce: the good must not be abundant or easy to create.

- Established history: the longer the good is perceived to have been valuable, the greater its appeal as a store of value.

- Censorship-resistant: how difficult is it for a third-party to prevent the owner of the good from using it?

Gold has historically served this purpose. It fits many of the characteristics of a good store of value. Governments for thousands of years issued their currencies backed in gold or other rare metals for many of the above reasons.

However, one of the main issues with gold is that it is difficult to transport in any large quantity. It is not portable. It is heavy and transportation of larger amounts of it is slow and costly.

Due to the need to transact quickly and over long distances, banks were developed which acted as a trusted third-party so that you could transact with representations of the available gold that you had in the bank.

Rather than paying you 2 units of gold by physically cutting off a little chunk of gold, I could just tell my bank to change ownership of those two units to you.

We would never have to even interact in the gold that backs the currency.

This requires us to trust the ledgers of the banks. In a full reserve system, all the paper certificates that represent the gold stored in the bank are redeemable.

Eventually, banks and governments realized that they could issue more paper money than exists in physical gold. This was similar to what happened when the currency itself was the gold coin. Governments would assign the same value to the coin but little by little decrease the amount of gold that the coin had. They could either do this by changing how they weigh the coin, by chipping little bits off of the coins, or by changing the formulation of the coins to contain less a percent of gold. This is effectively the same thing as printing more paper certificates that have no actual backing.

Currently, the major currencies are all called fiat currency. Fiat comes from Latin meaning “let it be done.” Despite what you still might think, fiat currencies including the US dollar are no longer backed by gold or silver.

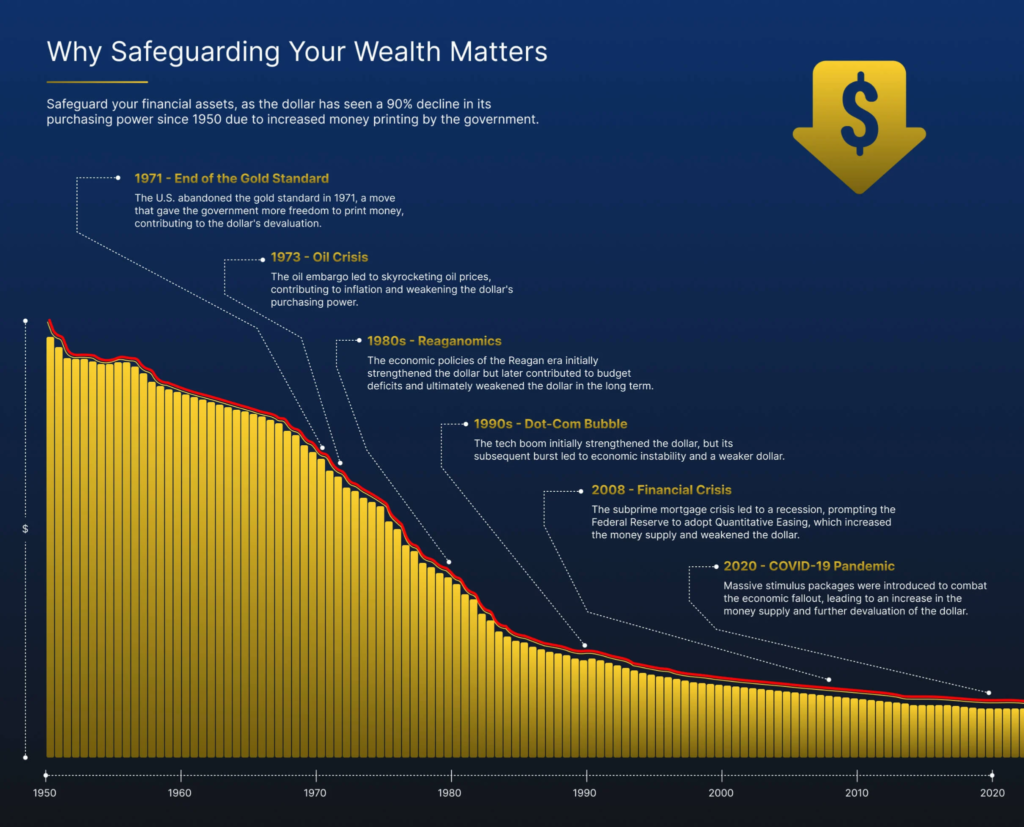

In 1971, Nixon took the US (and effectively the rest of the world) off of the gold standard. From that point on, the US dollar became a fiat currency. It no longer had convertibility into gold or other precious metals.

As governments finance projects by the creation of currency, the value of each unit of currency drops. There have been a number of examples of hyperinflation throughout recent history.

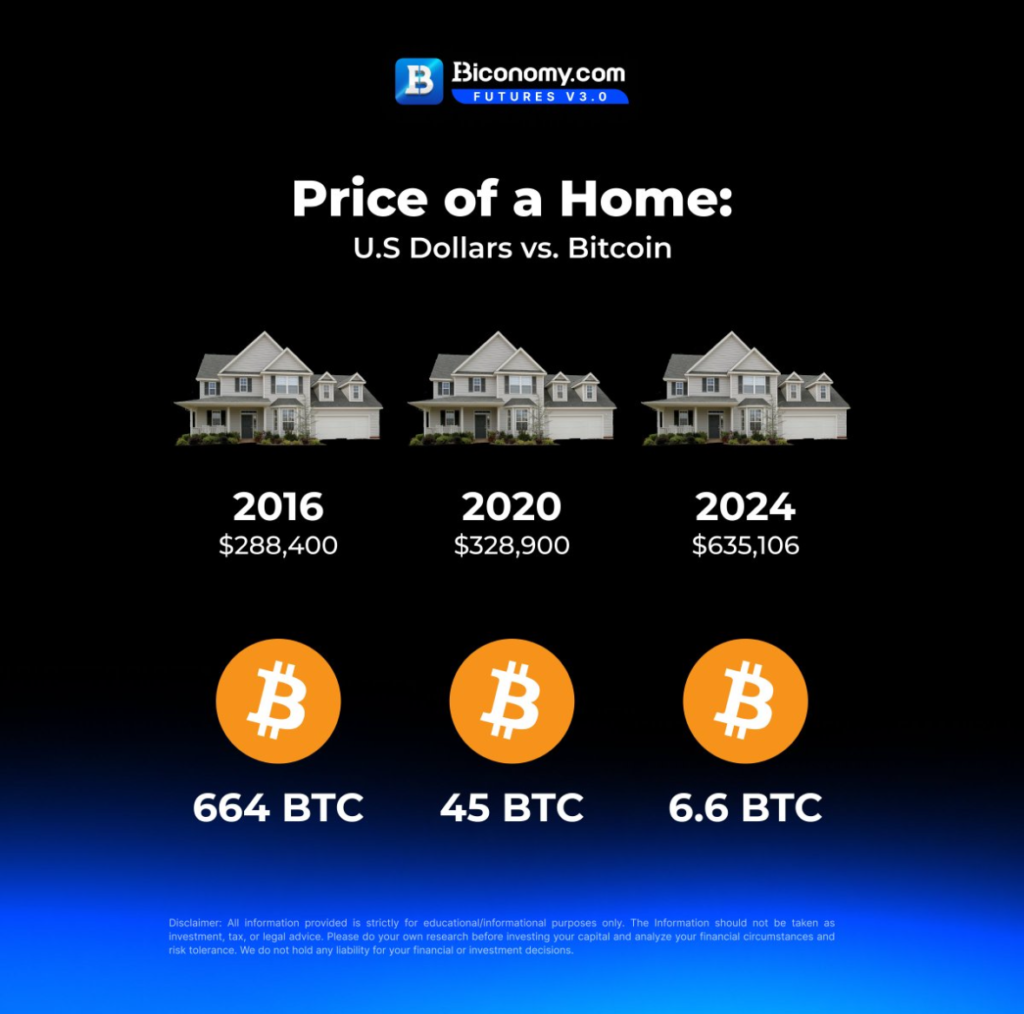

The US is not immune from inflation either, as you can probably tell from the cost of your groceries or how incomes have not kept up with the price of real estate. Today’s young adults are nearly close to getting priced out of being able to afford a house. House ownership is happening much later in life than our parents’ generation. This may be one of the reasons why young families are choosing to delay having children.

A $500,000 house today would be the equivalent of a $165,000 house 40-years ago. This inflation calculator can be adjusted yourself at https://www.usinflationcalculator.com/ and is likely to be underestimating the actual inflation since it relies on Consumer Price Index (CPI )data published by the US government. The calculations behind CPI have been adjusted over the years and actual inflation is likely to be much higher.

How does Bitcoin fit into the monetary system?

Bitcoin was released into the world by a pseudonymous person who goes by the name of Satoshi Nakamoto. Satoshi released the code so that anyone could run it. It has many of the same values that make gold good money, but since it is digital, it is infinitely divisible and can be sent anywhere very quickly and at very little cost.

Bitcoin is an immutable ledger that keeps track of ownership of the units of money called bitcoin. Each bitcoin is divisible into units called satoshis (sats). There are 100 million sats per bitcoin.

At the time of this post, bitcoin was valued at around 61,000 USD per bitcoin (BTC). 1 USD buys 1,640 sats.

Just as the banks historically have acted as a trusted ledger, bitcoin is a ledger where everyone has the same copy and a third-party is no longer needed.

Bitcoin is energy money. It literally is backed by mining which uses electricity to secure the blockchain (see below for more information on how bitcoin works). Bitcoin is the most secure computing network ever created. It functions as the base layer upon which additional financial layers are and will be built.

One unique property of Bitcoin is that it is the scarcest asset in the world. It is released on a fixed schedule and no more can ever be printed. Satoshi designed the system so that around the year 2140, the last bitcoin will be mined, resulting in just under 21 million bitcoins that will ever be created. It currently has an inflation rate of around 0.84%, which will drop in the year 2028 to 0.41%.

One unique difference between Bitcoin and every other valuable asset in the world, such as gold, is that as demand for it increases and its price goes up, no more of it can be mined. If it is uneconomic to mine gold at $2000/oz, then if gold surged to $4000/oz, suddenly new areas would open up to mining. This does not happen in Bitcoin. The amount of bitcoin in existence is released at a fixed scheduled.

Why is Bitcoin Needed?

When you earn dollars or any other fiat currencies, you are exchanging your valuable time for a token that reflects the value of the work that you did. We exchange our contributions to society, our energy in an abstracted form, and earn money. This fixes the coincidence of wants because the earned tokens are valued by everyone in the society. The problem is that through no fault of your own, the time that you worked to earn that money is being slowly stolen from you. As the government prints more and more money, that money is valued less and less. The government is effectively stealing from our future. Even the “target” inflation of 2% means that if you kept your money under the bed, in 35-36 years it would be worth half of what it had been worth.

Imagine the scenario where someone works hard all their life and saves those dollars. Upon retirement he’ll try to redeem all that hard work that he thought was stored into those dollars. What he’ll realize is that he wasted half of his life working for nothing thanks to the government slowly robbing him through inflation.

Inflation is a relatively hidden tax in the more stable western countries due to its lower rate, but is all too common in the less developed countries of the world where inflation can run over 20-50% year so even more in situations of hyperinflation.

To top it off, when you spend your inflated money, the government expects you to pay taxes on all of it. Tax when you earn it and additional taxes on any profits from investing it, even if all you did was keep up with the effects of inflation.

Inflation would be less of an issue if wages kept up with inflation, but that is not the case. Really the only thing that has allowed the wealthiest in the country to not be effected by inflation as much is their ability to earn enough that they can afford to invest the rest in assets like real estate or stocks. Both of these have historically been decent places to park your money until you need it. They are considered more risky investments. We should not be forced to place our hard earned money into risky investments just to have the chance of beating inflation. Someone that works hard all their life and stores his hard work as cash shouldn’t be penalized. This is one of the main reasons for the wealth inequality gap: the fact that the more wealthy are able to take the risk of holding everything but cash. The wealth gap is not because the rich are not taxed enough; it is a socialist attitude in my opinion that they are not paying their fair share.

As they say, bitcoin fixes this. By saving in bitcoin rather than cash, you are choosing to save in a system that is not inflationary. A system that has a fixed supply that a government cannot choose to create more of on a whim. A system that rewards you just by holding onto it.

Bitcoin is a reminder that a currency can exist without inflation. Without the government slowly stealing from us.

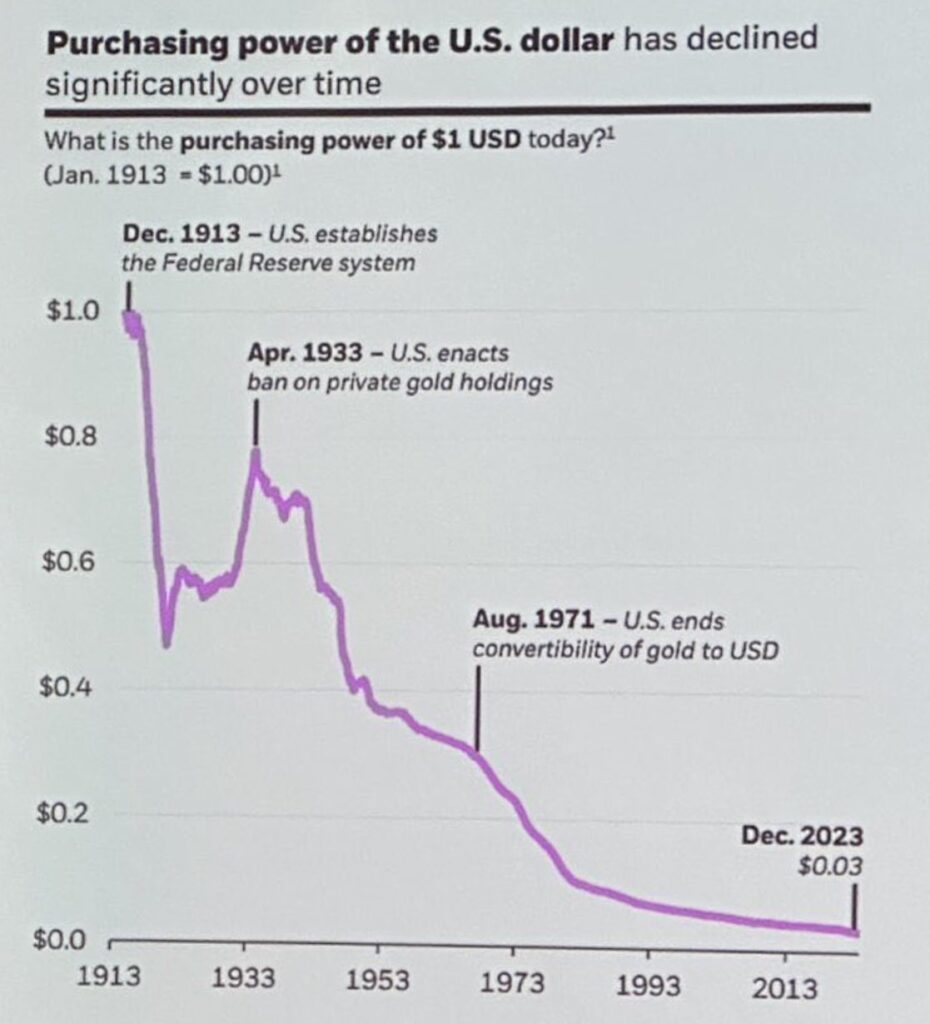

Bitcoin is an alternative to the dollar. The one thing that ties most investments together is that they are denominated in dollars, which has continuously lost value overtime. The chart below (from this site) shows that today’s dollars are worth 90% less than what they were worth in 1950. You work and are paid in dollars. You exchange your time on this earth for money that you then hope to be able to exchange for other people’s work at a future date.

Stocks and real estate will not go away, but their current purpose as a way to make sure you don’t lose value due to inflation will diminish as bitcoin continues to become more valuable. Future investments will have to be made on the basis of if you are willing to part with your bitcoin for that investment.

In the current system, real estate has gone from being a consumable good that people buy to live in and raise a family to a store of value. Very wealthy families and corporations are buying up real estate since, until bitcoin, there were only equities and real estate as a better alternative to put your money to store its value. (Gold could be considered a store of value too but historically has underperformed the stock market). As more and more real estate gets bought up by the wealthy, this means that the middle class can hardly afford to buy a house any longer as house prices get inflated higher and higher. Even children of wealthy families (unless getting support by the parents) are no longer able to afford a home independently until later in life than their parents or grandparents.

The average home price in 1950 was $7,354, which should equate to $93,602 in today’s dollars. However, that’s not the case today. The average home price is around $420,000. Has income increased that much to make up for the difference? The average family income in 1950 was $3,300. The average salary in US is around $64,000. If you factor in inflation, a $3,300 income in 1950 would equate to $43,200, so incomes have actually increased faster than inflation.

In 1950 the average home was 2.2x the average salary. Today the average home is 6.6x. What else is inflated? Are younger people’s 401k’s buying into a stock market that is similarly inflated for the same reason? With fiat money, we don’t actually know the true value of things any more. These are some of the issues, in my opinion, that bitcoin frees you from.

A transition to bitcoin will encourage businesses to produce higher quality products. We are currently living in the fiat mindset that we must constantly consume goods and services. Why hold onto our money for the future when it will just be worth less. We might as well spend it now because then we’d at least have something tangible. In a bitcoin world, businesses would compete on quality because they’d be fighting over where we’d spend our valuable bitcoin.

To continue on the theme of bitcoin being energy money, let’s consider pricing bitcoin in terms of barrels of oil.

At the end of August 2024, 1 BTC gets you 785 barrels of oil ($81/barrel). This is up from 309 barrels of oil a year ago, an increase in purchasing power of your bitcoin in terms of oil of 154%. The S&P 500 index moved from 4433 to 5613 over that same year period, an increase of 26.6%. In terms of oil, the S&P can buy you 31.2% more oil now than a year ago.

How does Bitcoin work?

When the bitcoin network was first turned on in 2009, there was no financial incentive to acquire bitcoin. In fact, a simple computer that anyone had at home was enough to “mine” hundreds of bitcoins. The cost to mine is the cost of the electricity and acquiring the hardware to do it.

Bitcoin is initially distributed through this process of mining. Approximately every 10 minutes a block is found. The block that fits a certain pattern is declared the winner and is able to add their block of transactions to the chain. Each subsequent block occurs roughly every 10 minutes and adds additional transactions to form a connected chain of blocks. The transactions are from anyone in the world interacting with the bitcoin network. The network was designed to self correct itself to ensure that over time the 10 minute per block rate is consistent. This self-correction happens through a difficulty adjustment programmed into the code and requires no human intervention. Every 2,016 blocks or roughly every 2 weeks, the difficulty will adjust to ensure that blocks come close to the 10 minute mark.

The incentive to mine is that the winner of the block is rewarded bitcoin. The first 210,000 blocks (roughly 4 years) were awarded 50 bitcoin per block. Every 210,000 blocks the network goes through what is called a halving where the block reward gets cut in half. 25 bitcoin per block, then 12.5 per block, 6.25 per block, and finally to the halving that we just experienced where each block gets rewarded 3.125 bitcoin per block. It is these halving cycles that ensures that the last bitcoin will get mined around the year 2140.

When you send bitcoin on the bitcoin network you get to choose a fee rate that you are willing to pay to get your transaction included in the next block. Miners get to pick the transactions they want to include. As bitcoin is used more and more, the cost to send the transactions will increase as people are willing to pay more for their transactions.

During high use times, the bitcoin main chain network can get fairly expensive. Additional layers are being built on top of Bitcoin that allow nearly instantaneous transactions for a fraction of the cost that still have final settlement, relying on the security of the full bitcoin network. The layer 2 that is most popular and is being developed as the language of the main payment layer for bitcoin is called Lightning. Lightning is the language by which most people will interact with bitcoin for their everyday transactions.

For information on how to use Lightning, please see the question below.

Isn’t Bitcoin bad for the environment?

One of the major campaigns going on against Bitcoin has been lead by Greenpeace and is funded by a competitor to Bitcoin. The claim is that Bitcoin’s energy usage is bad for the environment.

First, how much electricity does bitcoin use? In 2021, it was stated that bitcoin uses 0.55% of the global electricity production, or roughly the equivalent of small countries like Malaysia or Sweden. As the network gained strength and usage over the last few years, this number has continued to go up.

If you feel that bitcoin has no use, then maybe any amount of electricity use is too much. However, the amount of electricity that goes into bitcoin is directly proportional to the amount of people using bitcoin and how those people value the bitcoin.

The companies and individuals that mine bitcoin are incentivized to find the cheapest forms of energy since the higher cost electricity eats into their profits. Consequently, the majority of bitcoin mined today is mined by renewable energy and actually encourages the construction of energy producing equipment in areas of the world that would otherwise have been stranded without the availability of energy.

Here is an example: Why would a company choose to build a hydroelectric dam in the middle of Africa? It might be for humanitarian purposes, but the incentive has to at least be partially for profit in order for the endeavor to be sustainable.

The population that would benefit directly from having access to clean, nearly free energy from a hydroelectric dam would be not able to afford it. With bitcoin, these dams can be built and the energy basically given away to the local population to help improve their quality of life while any excess energy can be used by miners to mine bitcoin.

There is a reason to increase energy abundance in the world.

As mentioned above, bitcoin is literally energy that is saved in digital form to be either spent as bitcoin or converted to some other means of exchange in the future. And remember, that is all that money is. It should serve no other utility than being a unit of exchange that allows to different people to fairly exchange value.

Here’s another example showing the benefits to the environment from bitcoin. Let’s say a community wants to build a solar plant. It currently needs 50 MW during the day but at peak times might require up to 75 MW. You can’t build a solar plant that is capable of 75 MW unless you have a place to store the excess energy. Bitcoin can act as an energy battery. By choosing to build a plant of 100 MW, it would ensure that 50 MW would be available to the community with the other 50 MW used by the miners until there is a demand by the community for some of that energy. Then it is just a matter of turning off the power to the miners and suddenly that extra energy is available. Before bitcoin, the community would build a 50 MW plant and then have to power up a polluting natural gas or diesel plant when additional power was needed. Bitcoin fixes this. It is actually better for the environment.

Finally, another example: Large waste dumps generate a lot of methane. So much so that many of these sites use it to power their facilities and even with this require the excess methane to be burned since the carbon dioxide generated with burning is much better for the environment than releasing direct methane. Bitcoin can solve this too by using the energy generated from the methane fuel to mine bitcoin. It can convert a previous waste product into money.

How is Bitcoin different from the other “cryptocurrencies”?

Bitcoin is a cryptocurrency in the sense that it too uses cryptography (the technology that the Internet uses for encryption) to create and protect the bitcoin tokens. Bitcoin is different than most in that it uses a consensus mechanism called proof of work. The other major consensus mechanism is called proof of stake.

In Bitcoin, the chain of transactions that has the most work put into it is the real version. This work is costly in the sense that there is a lot of energy that is used to find the next block. This energy has real world costs that can’t be just duplicated on a whim. An easy way to think about it is that you look at someone who is really strong or fit. You can physically see the work that that individual put in to look like that. It isn’t something that can just be faked.

The second most valuable cryptocurrency is called Ethereum. Ethereum started as a proof of work competitor to Bitcoin but has since changed consensus mechanisms to a system called proof of stake. Proof of stake essentially says that the more tokens you hold, the more valuable your voice is in deciding what the correct chain is. It doesn’t require any actual work, only more of the Ethereum tokens.

There are also hundreds of thousands of cryptocurrencies out there. Some claim to do special things. Most of these are outright scams and have no product behind them at all. The few that actually do have a product run into the issue of how the supply of the token is released. Remember that bitcoin has a fixed release schedule that anyone could have joined early on.

Many, including Ethereum sold their tokens to early investors (for bitcoin nonetheless!) before they even hit the market and gave themselves millions of tokens. The reason that so many cryptocurrencies exist is that the creators think that they can convince people to buy their tokens or pump up the price of the tokens through speculation.

All of these altcoins are (or have been) going to zero in terms of bitcoin. Usually the ones “making money” are the founders of the altcoins, the exchanges like Coinbase or Binance that encourage their trading, and the people that get lucky by buying and selling at the right time.

Here’s a chart of the last year of Ethereum (the second largest cryptocurrency in market cap) priced in bitcoin:

The purpose of Bitcoin is not to get rich in the fiat sense, but to create a fair money that people can use to transact in and store today’s work for the future in a currency that will not be debased at the whim of a government.

Isn’t Bitcoin extremely volatile?

When bitcoin was initially developed, it had no value. Eventually as people saw that it fit many of the definitions of a good money, it gained value and now is one of the most valuables assets in the world. Volatility goes both ways, up as well as down. Obviously, what we are hoping for is upward volatility. Historically over its 15 year existence, any drops in fiat price have been excellent buying opportunities because its overall trend has been up.

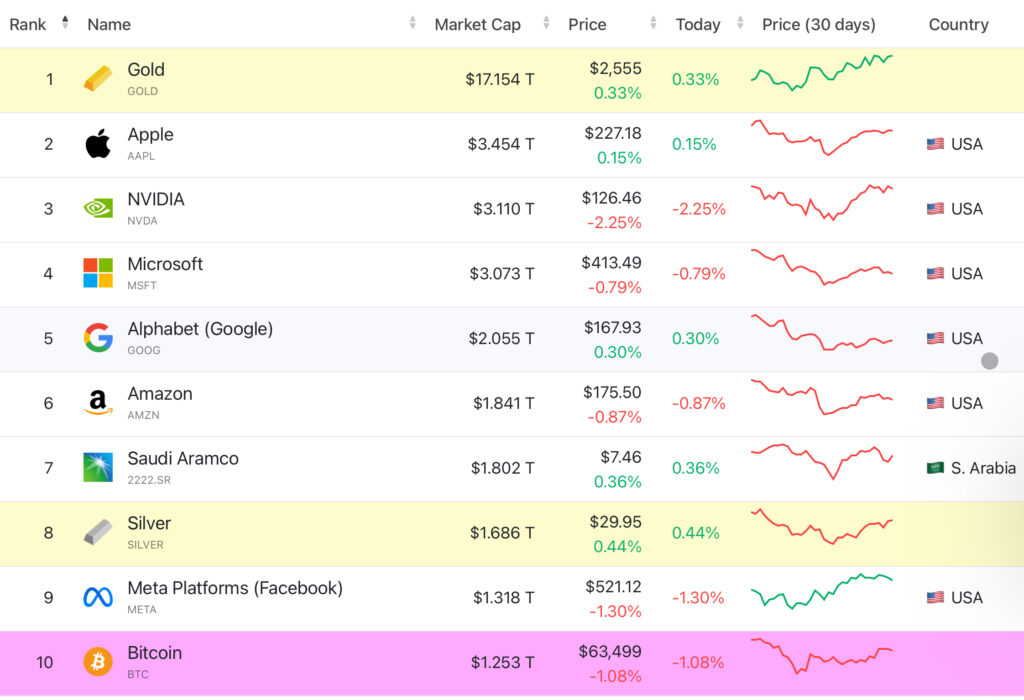

As of the end of August 2024, it is ranked #10 in the world in terms of value of all assets, including public companies, precious metals, cryptocurrencies, ETFs.

Of the precious metals, Gold is #1 at a USD value of 17.154 trillion. Silver is #8 at 1.686 trillion. And Bitcoin is #10 at 1.253 trillion.

Yes, bitcoin has been volatile but greatly to the upside if held for a long enough period of time. The volatility will decrease over time as the asset becomes more valuable. The volatility is also only a factor when it is compared to more stable fiat currencies like the US dollar over the short term.

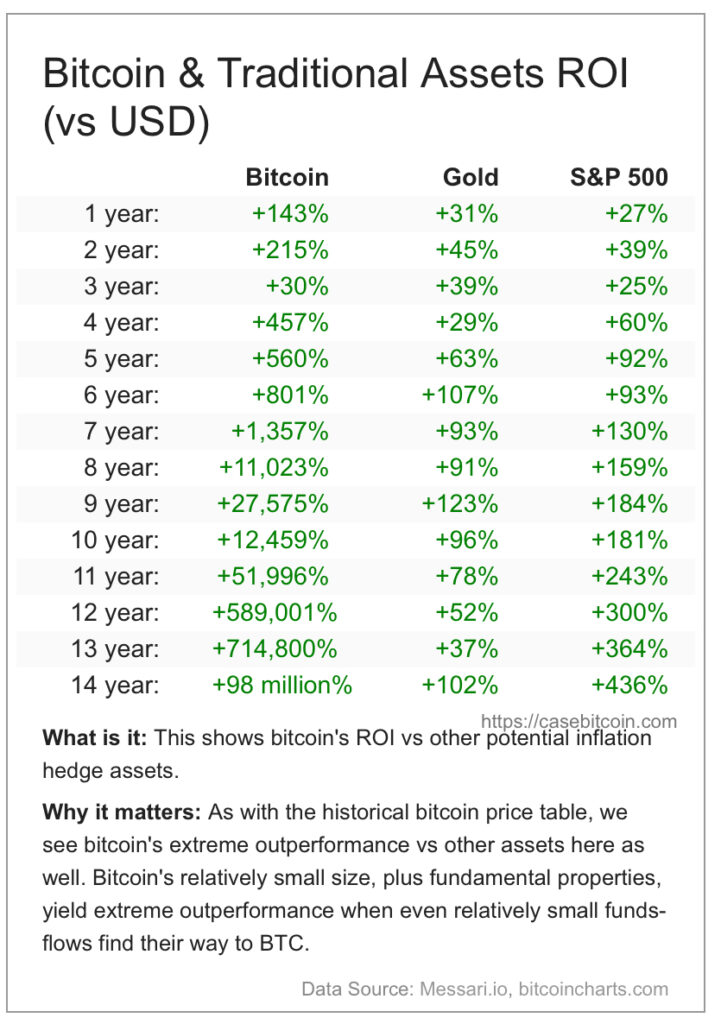

Bitcoin is very stable when compared to the purchasing power of currencies undergoing hyperinflation. I’d rather have the volatility of bitcoin but the compound annualized growth rate of historically 30+% per year (see charts below) instead of the slow and steady decline in purchasing power of the US dollar.

Another factor affecting volatility is due to Bitcoin’s inelastic nature. As demand for bitcoin increases, the price must go up as supply cannot be increased.

What will Bitcoin’s price be in the future?

This is the $1 million dollar question. Or maybe we should say the 15.7 BTC question.

No one knows this answer exactly. But you can almost say with certainty that over a long enough time frame, it will go up in fiat price. It is the world’s most pristine money. No more can be printed, it cannot be debased. As Michael Saylor famously said: It’s going up forever, Laura. (https://www.youtube.com/watch?v=zTPoRDrtc0s).

While they say that past performance is not indicative of future performance, here are some charts and tables showing how bitcoin has done historically:

While volatile, overtime it looks to be a much better store of value in terms of maintaining and growing purchasing power than any other major asset has been.

Michael Saylor gave a keynote speech at the Bitcoin Conference in Nashville 2024 where he outlines his case for Bitcoin through the year 2045 (21 years from now).

At the time of the presentation, Bitcoin was 0.1% of total global assets at market cap of $1.3T with a price of $65k.

Saylor’s bear case places Bitcoin at 2% of global assets in 2045 with a fiat price of $3 million per bitcoin. Market cap of $68T.

Base case of $13 million per bitcoin at 7% of global assets and a market cap of $280T.

Bull case of $49 million per bitcoin at 22% of global assets and a market cap of $1,030T.

How much should I allocate to bitcoin?

This question should be discussed with the help of your financial advisor. Most likely your financial advisor will advise you stay away from bitcoin and the other cryptocurrencies. Some might say that you can put a small amount into bitcoin if you have a small portion of your portfolio devoted to “play money,” while others might suggest a 1-2% allocation off the bat.

What you don’t want to happen is that you decide to go all in before you truly understand the space, experience a large downward move, and then become disillusioned with Bitcoin. Once you have gone down the rabbit hole, then you will appreciate a drop in prices because it allows you to buy more bitcoin for your money.

Today Bitcoin is still considered a risky investment and, therefore, is quite volatile. For a discussion about bitcoin volatility, please see the question above. It can make big moves up (or down) in price. As such, you should not put more into bitcoin than you are comfortable with. Bitcoin has historically made 80% corrections. It has always bounced back, but you should be prepared for large moves down like this.

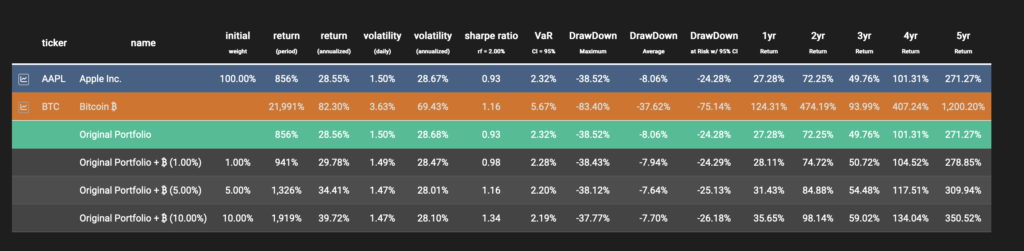

The Nakamoto Portfolio has a tool called Portfolio Analytics where you can plug in your current portfolio allocation and see what the results of adding bitcoin to it would have been. You can also select from common preset portfolio allocations, such as All Seasons or the classic 60/40.

It gives returns, drawdowns, Sharpe ratios, volatility values, etc. And it shows you what happens when you put a 1%, 5%, or 10% allocation to bitcoin. You enter your current or historical allocations to stock, bonds, ETFs, or mutual funds. You can set to not rebalance and let things change allocation percent based on performance or rebalance at a certain interval. What this shows is that unless you pick a specific stock at a specific timeframe (like buying Nvidia at its recent low and then holding through its high), the higher allocation to bitcoin helps reduce volatility, increase Sharpe ratio, and increase returns without worsening draw downs.

Here is a portfolio showing what would have happened if you had a portfolio that was 100% allocated to AAPL in December 2015 and then the effects of adding a 1%, 5%, or 10% allocation of BTC to that portfolio. The rebalancing happens semi-annually. A 10% allocation rebalanced semi-annually to bitcoin would have had a 5 year return of 350% versus 271% with AAPL alone. Volatility would have been essentially unchanged with both allocations at 28%, average drawdown about the same at 8.06% for AAPL and 7.7% for portfolio with bitcoin, and even no change in maximum drawdown with AAPL alone at 38.5% and bitcoin allocation at 37.8%. You get better returns with the same volatility and drawdowns.

This would be a good tool to use and tweak to your level of risk tolerance. It is written in a language that financial advisors will understand and would be a good one to share with them.

For me, other than having enough US dollars available to pay for bills on a monthly basis, I feel more comfortable having nearly all of my portfolio in bitcoin because it should trend upward quite significantly; holding the US dollar is a guaranteed loss of purchasing power.

Where do I get bitcoin?

One of the misconceptions about Bitcoin is that it has gotten too expensive. It is true that the price for 1 bitcoin has grown substantially over the year, but in order to participate in Bitcoin’s future growth, you don’t need to own whole bitcoins. You can buy less than a dollar worth of bitcoin, if you want!

Here are a couple ways that you can get bitcoin.

- Trade goods or services for it. If you are a business owner, consider offering to accept bitcoin as one the currencies that you take.

- Buy bitcoin with cash from someone or buy bitcoin on an exchange with your checking account. Popular bitcoin only exchanges include Strike, River, or Swan.

- Talk to anyone excited about bitcoin and he or she would probably be happy to help you set up a Lightning wallet and send you some sats to get started.

- Buy bitcoin miners. This is a more technical discussion, but you can materially participate in finding the next bitcoin block and get the mining rewards for this. As the amount of energy going into mining has increased, the cost to mine as gone up and unless you understand what you are getting into, sticking with one of the above ways to get bitcoin is much easier. Please reach out to me below if you have interest in mining bitcoin.

- Buy one of the Bitcoin ETFs in most brokerage accounts. Please see the question below.

Coinbase, Kraken, and Gemini are other popular exchanges. You can buy bitcoin here as well, just make to remove your bitcoin to cold storage (see below) as soon as possible. Ideally you do not want to keep bitcoin on any exchange because as long as the bitcoin is not in your personally controlled wallet, the bitcoin isn’t yours. You do not want to end up in a situation where you try to withdraw your bitcoin and the exchange stops you because they are insolvent. This happened recently to places like BlockFi, Celsius, and, what was the largest bitcoin exchange in the world at the time, FTX.

I prefer NOT to use these non-bitcoin only exchanges because they have moved from just selling bitcoin to offering many other coins colloquially called altcoins. They make money anytime people trade these altcoins, such as Ethereum mentioned above. So, rather than buying and holding like you should be doing with bitcoin, these exchanges encourage you to trade often. The more often you trade, the more they make money.

What you should be doing is buying bitcoin and then moving it into cold storage as soon as you can. Sometimes it takes a few days to a week for your deposited money to settle, a carryover from the legacy financial system.

Can you buy bitcoin within your brokerage account? Individual Retirement Accounts?

Yes, most brokerages allow you to buy shares of a bitcoin ETF. Two of the most popular are IBIT (managed by Blackrock) and FBTC (managed by Fidelity). These are not the same as holding bitcoin in cold storage because the bitcoin is held by the custodian and not by yourself. You are able to participate in any movement of the bitcoin price but are not otherwise able to interact with bitcoin besides trading the ETF.

These are decent alternatives for accounts in which you are not allowed to buy actual bitcoin. They do come with limitations. For one, they are securities and not commodities so if you do a lot of buying and selling, you do have to worry about the wash sale rule. Bitcoin held in self-custody does not need to worry about that rule.

Another limitation is that if you are buying the bitcoin ETF as a store of value and end up needing to access those funds, the ETFs only trade during the hours that the stock market is open. Bitcoin is tradable 24/7.

The bitcoin ETFs also have small fees. Most have expense ratios on the order of 0.25%. That is small but more than the S&P500. VOO has an expense ratios of 0.03% in comparison. Bitcoin held in self-custody has no ongoing fee besides the cost of maintaining and securing your hardware wallet.

Another limitation is for the more paranoid. Bitcoin held in self-custody is not able to be taken away from you while access to the value of bitcoin in an ETF could be halted by the order of a government.

Individual Retirement Accounts (IRAs) that are at brokerages allow you to buy any of the bitcoin ETFs. IRAs do also have the option of being opened at a company like Unchained or Swan IRA where you get to hold real bitcoin, not bitcoin held in an ETF. You can have more than one IRA open at a time.

Some 401ks can be converted into a self-directed 401k. This allows you to invest in things other than the preselected list of mutual funds, like the target date retirement fund that is the default for many programs. If your company allows you to do a self-directed 401k, then you might have the option of buying exposure to bitcoin via the ETFs

What is cold storage and why should I take my coins into cold storage?

Cold storage is just a term meaning that you should take self-custody of your bitcoin, most commonly by using a device that secures your bitcoin that is not directly connected to the Internet. Anything that touches the Internet risks being able to be more easily hacked. The goal is to control the private keys to your bitcoin yourself (aka self-custody) and not to trust any third-party. Bitcoin is bearer instrument that you should take into self-custody. Another way to think about it is if you are physically holding gold in your home vault (self-custody) versus trusting your gold to be held at a bank (third-party custody).

Most people that buy their bitcoin on Coinbase likely hold their bitcoin on Coinbase as well. Coinbase likes this because it encourages trading, which is how Coinbase makes its money. Bitcoin-only exchanges will encourage you to take bitcoin into self-custody. If you hold your bitcoin on Coinbase or any exchange, then that exchange could block your account and restrict access to your bitcoin.

Or if we run again into an FTX situation, your bitcoin might not have been real bitcoin in the first place. FTX was selling “paper” bitcoin that was just recorded on their own ledgers. When everyone tried to take their bitcoin off FTX, there was not enough real bitcoin available and FTX was forced into bankruptcy.

How do I use bitcoin?

Step 1 should be to convert as much of the depreciating currency (fiat) as you can into a currency that can never be debased. Bitcoin is a threat to the government’s monopoly on money and you should want to hold as much of it as you can.

Then just hold or as bitcoiners say, HODL. Some people say this stands for “hold on for dear life,” but it actually was a spelling mistake on a Reddit post from 2013!

More and more businesses are beginning to accept bitcoin. But until the world switches to the Bitcoin standard, most transactions in everyday life will be in trading bitcoin back into dollars whenever the temporary need for more dollars arises.

The two most popular ways to use bitcoin are by sending transaction on the main chain (“on-chain”) or by using a layer 2 solution called Lightning. There are custodial and non-custodial ways of doing both. Custodial is like your typical bank or investment account. You have access to the money on there as long as the bank or investment firm lets you access it. If the bank decides to freeze your accounts, then you can no longer access those funds because the custodian is the one ultimately in charge.

An example of a bitcoin custodian would be using a company like Strike. You hook up your checking account and buy bitcoin. As long as the bitcoin remains on your account held by Strike, the bitcoin is in their custody. If someone forced them to send your bitcoin somewhere or freeze your account, they would have to comply. Strike and all reputable custodians lets you remove the bitcoin into your own custody as soon as the funds settle. Strike has both the ability to send and receive Lightning payments as well as on-chain payments. A cool feature with them is that you can send a Lightning payment using dollars. It will be seamlessly converted into bitcoin and sent while from your end, you will just see dollars come out of your attached checking account.

Non-custodial is more commonly called self-custodial and means that you are the one in charge of your bitcoin. If you forget your password, PIN, or lose the private keys to your bitcoin, it is gone forever and no one will ever be able to help recover it.

Self-custody also lets you have access to your money even in the most oppressive countries. It makes it easy to put all your wealth into bitcoin and leave the country to start a new life elsewhere. The same can’t be said about cash, gold, or real estate. Imagine trying to cross the border carrying bags and bags of cash or bars of gold. Small amounts would be fine but larger amounts would be impossible to travel with safely.

If the people that had held their bitcoin in FTX had instead moved it immediately into self-custody, the FTX bankruptcy would not have affected them at all. Any reputable exchange should encourage if not require moving coins into self-custody.

Christian organizations are sending bitcoin as the currency of choice to their missionaries overseas. Many of these missionaries are in areas of the world where it is difficult or very costly to send US dollars or even to send dollars and get it converted into the local currency. Relying on the legacy system means jumping through multiple layers. In addition to fees, the legacy system is also slow. By using Bitcoin, these organizations are able to send large or small amounts of bitcoin nearly instantaneously to anywhere in the world. The missionaries are then able to spend the bitcoin as they need or to convert the bitcoin to the local currency at their convenience.

The Thank God For Bitcoin organization (https://tgfb.com) is an excellent resource for more information about how other churches are using bitcoin.

Two excellent videos on this are:

Funding Ministry in an Expensive Time & Place

How Bitcoin Transforms Funding for Global Missions with Ahshuwah Hawthorne

What is Lightning?

Lightning is an additional layer on top of main chain bitcoin. It can be considered as a payment layer of bitcoin. It allows nearly instantaneous settlement. Main chain bitcoin refers to settlement on the capital B Bitcoin network. Currently fees are quite low but when demand increases, the fees to transact directly on the main chain rise and smaller transactions could be slow and/or costly. Final settlement means that the bitcoin has transferred to the receiver of the bitcoin and cannot be reversed. This usually takes 10 minutes to an hour depending on the size of the transaction. In the legacy financial system the credit card network charges merchants a fee to tell them the transaction is authorized. This fee is usually a fixed amount plus a percentage. Merchants either charge this directly to the credit card user or otherwise include it in the cost of the product. (This is why some stores give discounts for cash payments or restrict credit card payments to only amounts larger than $5 or $10.

In the time it takes to use Apple Pay, tap, or swipe your card, this notification to the merchant generally just takes a few seconds and allows you to buy the product you desire. To the end user, we get our product and the transaction seems settled. To the merchant, it will take a couple days for all the banks to interact with each other and for the money to actually settle into the account of the merchant. The delay is there due to each party along the way needing to run fraud checks and to take their cut of the money.

As they say, Bitcoin fixes this. Lightning bypasses the traditional delayed settlement and allows final settlement where the merchant can ensure that the actual bitcoin is in their account before giving out the purchased product. There can be no chargebacks or fraud.

Here’s how a Bitcoin transaction works:

Today’s fees (end of September 2024) are quite low and a single transaction with final settlement in the next block (typically around 10 minutes) would cost only 72 cents. This is regardless of the amount of the transaction. Buying a coffee for $4 would cost 72 cents and sending $3 billion would cost 72 cents. 72 cents isn’t much with a larger transaction. It is 18% of the cost of the coffee. For smaller or everyday purchases, even a low fee on-chain transaction is not ideal.

As fees increase, as shown here, it might cost single digit dollars to low hundreds of dollars to settle on the main bitcoin chain. Settling on-chain is the gold standard because you have the entire security backing the entire Bitcoin network.

However, buying a coffee on-chain would not be smart because 1) the merchant has to wait at least 10 minutes to ensure final settlement and 2) fees could be become more expensive than the cost of the coffee.

This is where Lightning comes into play. Even in high fee environments, final settlement for a $4 coffee would run less than 2 cents. Another benefit is near instantaneous final settlement. The benefit to you and the merchant is that neither is waiting for a transaction to finish. Lightning also has the backing of the entire security of the main Bitcoin network. Please reach out to me below if you want to discuss the technical reasons for this security despite its much lower cost.

What Lightning wallets do you recommend?

The easiest are custodial solutions, like the Lightning wallet built into Strike (referral link to get $500 worth of fee free purchasing) or the bitcoin/Lightning wallet from Coinos. For one of the easiest to use self-custodial options, I’d recommend download Breez wallet for iPhone or Android.

Setup videos for Breez are here:

TFTC Guides: Lightning Network for Beginners with Breez Wallet

Breez Wallet: Flexibility & Sovereignty For The Bitcoin Lightning Network

How To Use A Bitcoin Lightning Wallet: Breez

More technical users may like Zeus Lightning Wallet

Please reach out to me below for other questions or to help set up your own wallet.

What does the Bible say about Bitcoin?

Bitcoin was created (or found, as some people say), in 2009. It is obviously not directly discussed in the Bible. However, many of the attributes of Bitcoin are discussed in the Bible.

In Genesis 1:27, we learn that “God created man in His own image, in the image of God He created him;” We have the “divinely-delegated authority to create useful things with our hands.”1 Money is a tool to collectively allow the community to produce more output than individuals can do in isolation.2 Money as an essential tool for the flourishing of civilization is a gift from God.3

What about Matthew 6:24? “No one can serve two masters. Either you will hate the one and love the other, or you will be devoted to the one and despise the other. You cannot serve both God and money.”

“Truly understanding what money is will reduce the power that money has over us.”4 Money does not have to rule our lives, become an obsession, or have to be a source of pain in the world.5 “Money can be received with thanksgiving and viewed as a good gift that serves us, not the other way around.”6

“Moral and immoral money have existed throughout history.”7 “Once we understand the negative changes to our money, we can avoid the immoral incentives inherent to the unsound money that we have today.”8

“Do not be deceived, God is not mocked; for whatever a man sows, this he will also reap.” – Galatians 6:7

God gives us the will and ability to sustain and multiply ourselves. Investment and its returns are a part of God’s design, making work an integral part of being human.9

“Money is an integral part of life because work is an integral part of life.”10 Work is creating something of value for ourselves and others.11 Work is hard.12 It adds value by creating new goods and services that improve people’s lives.13 “Work that adds value should get rewarded.”14 Theft destroys value, stealing something of value from others.15

Money is a tool to measure the value of work.16 It allows specialization within a society. Prior to non-commodity forms of money, we ran into the issue of coincidence of wants. If I only produced eggs and wanted to buy some milk, then the milk seller would hopefully want to buy some eggs. If he didn’t, then trade would be difficult because I would need to acquire something that he also wants. A good money is one that is not consumed itself but rather decided on by society to be valuable. The value of your work is assigned a certain number of units and those number of units are determined by what society values. A sound money system allows us to “sacrifice our time today for money that can be redeemed for something of similar value in the future”.17

Proverbs 16:11 says “A just balance and scales are the Lord’s; all the weights in the bag are his work.”

Proverbs 11:1 says “The Lord detests dishonest scales, but accurate weights find favor with him.”

God desires us to work in His image and maintain and grow His work throughout the world. The value of each of the contributions should be rewarded in a fair money appropriate for the value of work done.

Jesus said “the laborer deserves his wages..” Luke 10:7

When we are paid in fiat money, we are paid in money that can be perpetually debased. As our money gets inflated through printing of new money, the purchasing power of each unit of money decreases.

Here’s a chart showing how the purchasing power of the US dollar has decreased since the establishment of the Federal Reserve System in 1913.

The time that we sacrificed to do work and earn money is stolen from us. In Exodus 20:15, God said “You shall not steal.” This command is universal. Just as individuals should not steal from a merchant or their neighbor, central banks should not steal purchasing power from the people through inflation.

At a “goal” of 2% inflation, the purchasing power of our money is halved in about 35 years. At the targeted inflation of 3%, we lose half of our purchasing power in just over 23 years.

God desires that we earn the money we deserve. Monetary inflation increases the supply of money and makes it less and less valuable overtime. In the same way that Roman authorities used unjust scales, clipped off portions of their coins, or decreased the amount of pure gold or silver in the coins, direct printing of money by government decree is effectively no different.

A laborer who sacrificed most of his life providing for his family would retire and find that the money he saved is no longer worth the time he put into it. It is not just money that was stolen from him but literally time on this earth that he could have instead spent with his family, doing something enjoyable or productive.

Proverbs 22:22 says “Do not rob the poor, because he is poor, or crush the afflicted at the gate…“

Fiat money does just that…

As there are more units of money available, prices of products and assets rise to match. The rich get rewarded as they own assets that appreciate with inflation, like gold, real estate, and stocks. The rising inflation punishes the poor as they may be trying to save up for years and years to purchase these assets, but their cost may be constantly out of their reach, largely due to asset inflation from the rich putting their money here.

“The form of money we use affects everything we do.”18 “Bad money incentivizes immoral behavior.”19 Under the Bitcoin standard, there would be less incentive for consumption because our money would hold its value and become more valuable in the future. Products might be better designed and built to last longer so that they don’t need to be replaced as often. And governments would be accountable to its citizens; politicians wouldn’t be able to promise “free money” if elected20; and there would be real budget constraints.21

Bad money encourages behavior like what was described in Proverbs 24:30-31:

“I passed by the field of a lazy one, and by the vineyard of a person lacking sense, and behold, it was completely overgrown with weeds; its surface was covered with weeds, and its stone wall was broken down.”

Bitcoin fixes this. Bitcoin encourages a lower time preference with planning towards a more abundant future.22 It encourages families and helps us view children as a blessing, not as a cost to us or society.23

The Church is made up of people. An economic reformation of the Church requires the economic reformation of the congregants.24 Bitcoin can help the Church recover from fiat money’s corrupting effects and instead become a congregation full of people free from the worship of money and solely devoted to God and the work that He desires for us.25

“God blessed them; and God said to them, ‘Be fruitful and multiply, and fill the earth, and subdue it; and rule over the fish of the sea and over the birds of the sky and over every living thing that moves on the earth.’” -Genesis 1:28

Bitcoin fixes many of the corruptions of our current monetary system, but it is not a panacea.26 Good money is a gift that can help us be better but we must fight the temptation to worship the work of our own hands.27 Instead we must focus on living lives in love and service to others.28

“Yet God has made everything beautiful for its own time. He has planted eternity in the human heart, but even so, people cannot see the whole scope of God’ s work from beginning to end. So I concluded there is nothing better than to be happy and enjoy ourselves as long as we can. And people should eat and drink and enjoy the fruits of their labor, for these are gifts from God.”

-Ecclesiastes 3:11

God continues to be at work even today.29 Bitcoin is an invitation to slow down, step off the fiat treadmill, and became more aware of God’s benevolence and the blessings that we receive from Him. Corruption of money and resultant economic uncertainty is one of the things that leads to a hurried lifestyle that many of us are perpetually in.30

Money and the discussion of money doesn’t have to be whispered with a mixture of fear, anxiety, or greed.31 Money is a gift from God and good money, sound money, should be a blessing to us and others around us.32

“Money is a means to trade, and trade is a means for creating useful things for the community.”33 “Money … is a necessary ingredient for the fullest expression of who God created us to be.“34 “Bad money … draws us toward the worship of created things rather than the Creator. Good money helps us fulfill our purpose and brings us closer to God.”35

Why donate bitcoin directly? Are bitcoin donations considered tax-deductible?

Primary reason for donating bitcoin is that it is a better form of money. By maintaining and growing in purchasing power, it is the best way to support the missions of the church or any charity.

Also, since it has grown so much in value already over the years, donating a highly appreciated asset is one way to reduce federal taxes and be able to direct more of that money to a charity that you support.

Let’s say you purchased $5,000 worth of bitcoin and it is now worth $55,000.

Option 1: You sell the bitcoin holding and pay a 20% capital gains tax on the proceeds, which would total $10,000. You could then donate the post-tax cash (and claim a tax-deduction for the same amount) of $45,000.

Option 2: You donate the entire amount to a nonprofit, pay $0 in capital gains taxes, and the full $55,000 goes to the charity. The donor could then claim a federal income tax deduction of the full $55,000.

Yes, bitcoin donations are fully deductible from federal taxes.

What are the tax responsibilities for donated bitcoin?

Now that you’ve decided to donate bitcoin, what are the tax responsibilities?

If you use the standard deduction when you file your taxes, then the below information does not apply to you. You cannot claim charitable donations unless you itemize. A tax strategy that you could use is to group multiple years worth of itemized deductions into a single year in order to get the tax benefit of the donations for that year.

If you itemize and you have donated more than $500 and wish to claim a federal tax deduction then you have to submit IRS Form 8283. This is where noncash contributions are tracked. If the total aggregate amount is less than $5000, then the donor can report the fair market value on Form 8283 himself.

If the total amount exceeds $5,000, then the IRS currently requires an independent qualified appraiser decide on the Fair Market Value of the gifts. The donor or donee is not allowed to declare this himself.

After a qualified appraiser fills out Form 8283, both the donor and donee sign it and then the donor is able to count the qualified amounts as a tax deduction.

I would recommend using the appraisal services from https://cryptoappraisers.com. Randy charges a flat $120 for a single appraisal and an additional $180 for up to 20 appraisals.

The IRS currently requires a qualified appraisal for the bitcoin donation. This generally costs $120-300. If you do 1 bitcoin donation a month, the cost for the appraisal would be at the $300 level in order to get all the donations from the entire year appraised. You’ll have to look at the amount of bitcoin donations you did and decide if it is worth paying the appraisal fee to otherwise get the full tax deduction.

If you donate more than $1,500 of bitcoin a year, then paying for the appraisal is worth it. 20% of $1,500 is $300. You’ll have to do the math, but depending on your cost basis for the donated bitcoin. It may either be cheaper to sell the bitcoin, pay the 20% capital gains, and donate what’s left.

Where can I learn more?

Excellent 2 hour long beginner level video: Jack Mallers on Tetragrammaton with Rick Rubin

Free introductory course called Welcome to Bitcoin from Swan Bitcoin

End The FUD – The best articles debunking Bitcoin FUD

Thank God for Bitcoin website: Sound Money Matters. Our goal is to educate and equip Christians to understand Bitcoin and use it for the glory of God and the good of people everywhere.

Saifedean’s Austrian economics course: ECON103: Principles of Austrian Economics

Should Christians Invest in Bitcoin?

Love Your Neigbour Money pamphlet by Pastor Alin Armstrong

The Economics of War with Alex Gladstein

What is Money, Anyway – Lyn Alden

(Part 1),

(Part 2),

(Part 3)

“If a money (the most salable good) is easy to create more of, then any rational economic actor would just go out and create more money for herself, diluting the whole supply of it. If an asset has a monetary premium on top of its pure utility value, then it’s strongly incentivizing market participants to try to make more of it, and so only the forms of money that are the most resistant to debasement can withstand this challenge.” – Lyn Alden (https://www.lynalden.com/what-is-money/)

A guy named Guy Swann on Bitcoin Audible has a great series on fiat money too. He was conservative politically but has converted to be libertarian and has a couple of great podcasts talking about money. These are some of my favorite because he goes heavy into economics on these:

Fiat Materialism

How Inflation Destroys Civilization

Fiat Waste “People look around and they see a wasteful world. They see endless, mindless consumption. Increasingly, we see people fearing the future rather than hoping for it.”

Fiat Replacement Theory “Fiat money has a collection of malincentives and consequences for the degrading and rotting of society. As we covered in the first part of this series, it leads to mindless consumerism and a more materialist culture. As we continue, I want to cover something else that it does by stealing the value of our savings which is our bet on the future health and capacity of society to provide for us. What happens when we are forced to bet against the future. As well as artificially lowering the price to replace things in the economy, until an enormous amount of the economic engine is built around quick financing, low quality products, and then throwing it away to finance the next thing. It’s time for a Guy’s Take episode, This is The Fiat Replacement Theory.”

Fiat Finance “Many people make the serious miscalculation, that if the CPI isn’t too high, then printing money isn’t a problem and doesn’t really cost them anything. This couldn’t be further from the truth. All it means is that the cost is just that much harder to see. But if you want to look at something that is truly dominated by the fiat culture and incentives of the money, there is no better example, than finance. This is where the money printing begins, and so all of the disastrous effects of monetary inflation and fiat, occur first, and to the greatest degree, in the financial sector. So take a dive, into fiat finance. Its time for a guy’s take episode…”

Do you have any book recommendations?

Thank God for Bitcoin: The Creation, Corruption and Redemption of Money

The Bitcoin Standard: The Decentralized Alternative to Central Banking (Saifedean Bookstore)/Amazon

Broken Money: Why Our Financial System is Failing Us and How We Can Make it Better (Saifedean Bookstore)/Amazon

The Price of Tomorrow: Why Deflation Is the Key to an Abundant Future

References

Armstrong, Pastor Alin., Love Your Neighbour Money. PDF Pamphlet. https://thebibleandbitcoin.com/should-christians-invest-in-bitcoin/.

Boyapati, Vijay. The Bullish Case for Bitcoin. 2018. https://vijayboyapati.medium.com/the-bullish-case-for-bitcoin-6ecc8bdecc1.

Waltchack, D., Higgins, G., Mekhail, G., Song, J., Bush, J.M., Tourianski, J., Pratt, L., & Breedlove, R. Thank God for Bitcoin The Creation, Corruption and Redemption of Money. Bitcoin and Bible Group, 2020.

Footnotes

1. Waltchack, D. et al. Thank God for Bitcoin The Creation, Corruption and Redemption of Money (Bitcoin and Bible Group, 2020), 14.

2. Waltchack, D. et al. Thank God for Bitcoin The Creation, Corruption and Redemption of Money (Bitcoin and Bible Group, 2020), 14.

3. Waltchack, D. et al. Thank God for Bitcoin The Creation, Corruption and Redemption of Money (Bitcoin and Bible Group, 2020), 15-16.

4. Waltchack, D. et al. Thank God for Bitcoin The Creation, Corruption and Redemption of Money (Bitcoin and Bible Group, 2020), 15.

5. Waltchack, D. et al. Thank God for Bitcoin The Creation, Corruption and Redemption of Money (Bitcoin and Bible Group, 2020), 16.

6. Waltchack, D. et al. Thank God for Bitcoin The Creation, Corruption and Redemption of Money (Bitcoin and Bible Group, 2020), 16.

7. Waltchack, D. et al. Thank God for Bitcoin The Creation, Corruption and Redemption of Money (Bitcoin and Bible Group, 2020), 16.

8. Waltchack, D. et al. Thank God for Bitcoin The Creation, Corruption and Redemption of Money (Bitcoin and Bible Group, 2020), 16.

9. Waltchack, D. et al. Thank God for Bitcoin The Creation, Corruption and Redemption of Money (Bitcoin and Bible Group, 2020), 16-17.

10. Waltchack, D. et al. Thank God for Bitcoin The Creation, Corruption and Redemption of Money (Bitcoin and Bible Group, 2020), 17.

11. Waltchack, D. et al. Thank God for Bitcoin The Creation, Corruption and Redemption of Money (Bitcoin and Bible Group, 2020), 17.

12. Waltchack, D. et al. Thank God for Bitcoin The Creation, Corruption and Redemption of Money (Bitcoin and Bible Group, 2020), 18.

13. Waltchack, D. et al. Thank God for Bitcoin The Creation, Corruption and Redemption of Money (Bitcoin and Bible Group, 2020), 18.

14. Waltchack, D. et al. Thank God for Bitcoin The Creation, Corruption and Redemption of Money (Bitcoin and Bible Group, 2020), 18.

15. Waltchack, D. et al. Thank God for Bitcoin The Creation, Corruption and Redemption of Money (Bitcoin and Bible Group, 2020), 18.

16. Waltchack, D. et al. Thank God for Bitcoin The Creation, Corruption and Redemption of Money (Bitcoin and Bible Group, 2020), 18.

17. Waltchack, D. et al. Thank God for Bitcoin The Creation, Corruption and Redemption of Money (Bitcoin and Bible Group, 2020), 19.

18. Waltchack, D. et al. Thank God for Bitcoin The Creation, Corruption and Redemption of Money (Bitcoin and Bible Group, 2020), 111.

19. Waltchack, D. et al. Thank God for Bitcoin The Creation, Corruption and Redemption of Money (Bitcoin and Bible Group, 2020), 111.

20. Waltchack, D. et al. Thank God for Bitcoin The Creation, Corruption and Redemption of Money (Bitcoin and Bible Group, 2020), 55 and 115.

21. Waltchack, D. et al. Thank God for Bitcoin The Creation, Corruption and Redemption of Money (Bitcoin and Bible Group, 2020), 114.

22. Waltchack, D. et al. Thank God for Bitcoin The Creation, Corruption and Redemption of Money (Bitcoin and Bible Group, 2020), 119.

23. Waltchack, D. et al. Thank God for Bitcoin The Creation, Corruption and Redemption of Money (Bitcoin and Bible Group, 2020), 120.

24. Waltchack, D. et al. Thank God for Bitcoin The Creation, Corruption and Redemption of Money (Bitcoin and Bible Group, 2020), 122.

25. Waltchack, D. et al. Thank God for Bitcoin The Creation, Corruption and Redemption of Money (Bitcoin and Bible Group, 2020), 122.

26. Waltchack, D. et al. Thank God for Bitcoin The Creation, Corruption and Redemption of Money (Bitcoin and Bible Group, 2020), 124.

27. Waltchack, D. et al. Thank God for Bitcoin The Creation, Corruption and Redemption of Money (Bitcoin and Bible Group, 2020), 124.

28. Waltchack, D. et al. Thank God for Bitcoin The Creation, Corruption and Redemption of Money (Bitcoin and Bible Group, 2020), 124.

29. Waltchack, D. et al. Thank God for Bitcoin The Creation, Corruption and Redemption of Money (Bitcoin and Bible Group, 2020), 127.

30. Waltchack, D. et al. Thank God for Bitcoin The Creation, Corruption and Redemption of Money (Bitcoin and Bible Group, 2020), 127.

31. Waltchack, D. et al. Thank God for Bitcoin The Creation, Corruption and Redemption of Money (Bitcoin and Bible Group, 2020), 129.

32. Waltchack, D. et al. Thank God for Bitcoin The Creation, Corruption and Redemption of Money (Bitcoin and Bible Group, 2020), 129.

33. Waltchack, D. et al. Thank God for Bitcoin The Creation, Corruption and Redemption of Money (Bitcoin and Bible Group, 2020), 129.

34. Waltchack, D. et al. Thank God for Bitcoin The Creation, Corruption and Redemption of Money (Bitcoin and Bible Group, 2020), 129.

35. Waltchack, D. et al. Thank God for Bitcoin The Creation, Corruption and Redemption of Money (Bitcoin and Bible Group, 2020), 129.