This is post is taken from the Frequently Asked Questions.

This question should be discussed with the help of your financial advisor. Most likely your financial advisor will advise you stay away from bitcoin and the other cryptocurrencies. Some might say that you can put a small amount into bitcoin if you have a small portion of your portfolio devoted to “play money,” while others might suggest a 1-2% allocation off the bat.

What you don’t want to happen is that you decide to go all in before you truly understand the space, experience a large downward move, and then become disillusioned with Bitcoin. Once you have gone down the rabbit hole, then you will appreciate a drop in prices because it allows you to buy more bitcoin for your money.

Today Bitcoin is still considered a risky investment and, therefore, is quite volatile. For a discussion about bitcoin volatility, please see the question above. It can make big moves up (or down) in price. As such, you should not put more into bitcoin than you are comfortable with. Bitcoin has historically made 80% corrections. It has always bounced back, but you should be prepared for large moves down like this.

The Nakamoto Portfolio has a tool called Portfolio Analytics where you can plug in your current portfolio allocation and see what the results of adding bitcoin to it would have been. You can also select from common preset portfolio allocations, such as All Seasons or the classic 60/40.

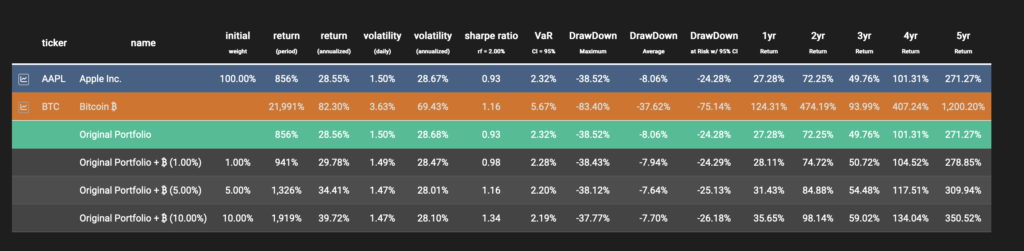

It gives returns, drawdowns, Sharpe ratios, volatility values, etc. And it shows you what happens when you put a 1%, 5%, or 10% allocation to bitcoin. You enter your current or historical allocations to stock, bonds, ETFs, or mutual funds. You can set to not rebalance and let things change allocation percent based on performance or rebalance at a certain interval. What this shows is that unless you pick a specific stock at a specific timeframe (like buying Nvidia at its recent low and then holding through its high), the higher allocation to bitcoin helps reduce volatility, increase Sharpe ratio, and increase returns without worsening draw downs.

Here is a portfolio showing what would have happened if you had a portfolio that was 100% allocated to AAPL in December 2015 and then the effects of adding a 1%, 5%, or 10% allocation of BTC to that portfolio. The rebalancing happens semi-annually. A 10% allocation rebalanced semi-annually to bitcoin would have had a 5 year return of 350% versus 271% with AAPL alone. Volatility would have been essentially unchanged with both allocations at 28%, average drawdown about the same at 8.06% for AAPL and 7.7% for portfolio with bitcoin, and even no change in maximum drawdown with AAPL alone at 38.5% and bitcoin allocation at 37.8%. You get better returns with the same volatility and drawdowns.

This would be a good tool to use and tweak to your level of risk tolerance. It is written in a language that financial advisors will understand and would be a good one to share with them.

For me, other than having enough US dollars available to pay for bills on a monthly basis, I feel more comfortable having nearly all of my portfolio in bitcoin because it should trend upward quite significantly; holding the US dollar is a guaranteed loss of purchasing power.

Leave a Reply