This is post is taken from the Frequently Asked Questions.

When bitcoin was initially developed, it had no value. Eventually as people saw that it fit many of the definitions of a good money, it gained value and now is one of the most valuables assets in the world. Volatility goes both ways, up as well as down. Obviously, what we are hoping for is upward volatility. Historically over its 15 year existence, any drops in fiat price have been excellent buying opportunities because its overall trend has been up.

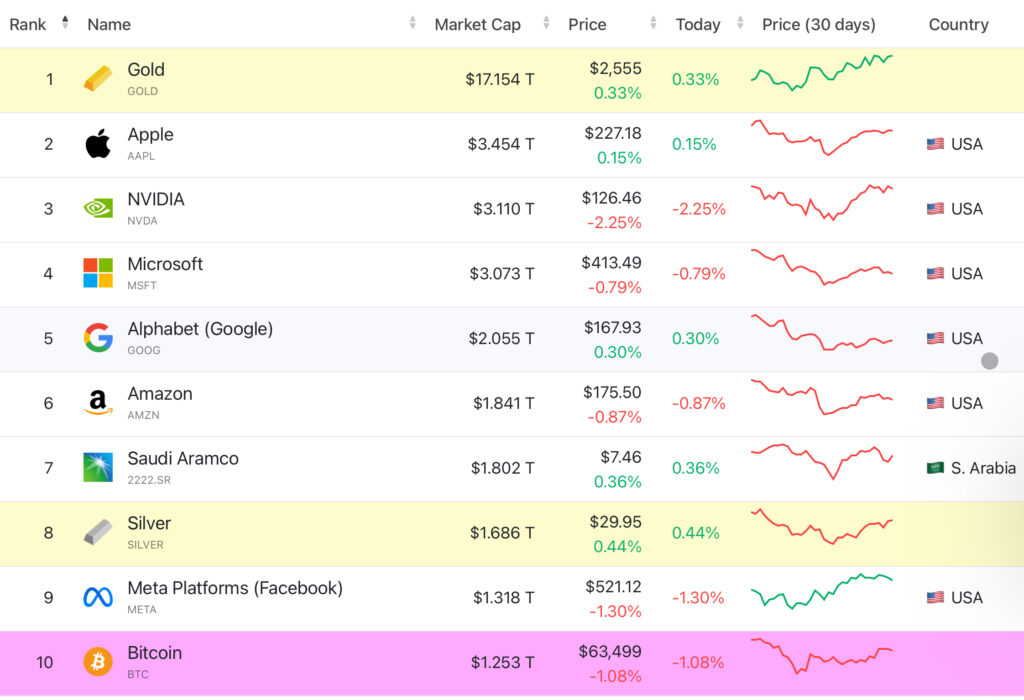

As of the end of August 2024, it is ranked #10 in the world in terms of value of all assets, including public companies, precious metals, cryptocurrencies, ETFs.

Of the precious metals, Gold is #1 at a USD value of 17.154 trillion. Silver is #8 at 1.686 trillion. And Bitcoin is #10 at 1.253 trillion.

Yes, bitcoin has been volatile but greatly to the upside if held for a long enough period of time. The volatility will decrease over time as the asset becomes more valuable. The volatility is also only a factor when it is compared to more stable fiat currencies like the US dollar over the short term.

Bitcoin is very stable when compared to the purchasing power of currencies undergoing hyperinflation. I’d rather have the volatility of bitcoin but the compound annualized growth rate of historically 30+% per year (see charts below) instead of the slow and steady decline in purchasing power of the US dollar.

Another factor affecting volatility is due to Bitcoin’s inelastic nature. As demand for bitcoin increases, the price must go up as supply cannot be increased.

Leave a Reply